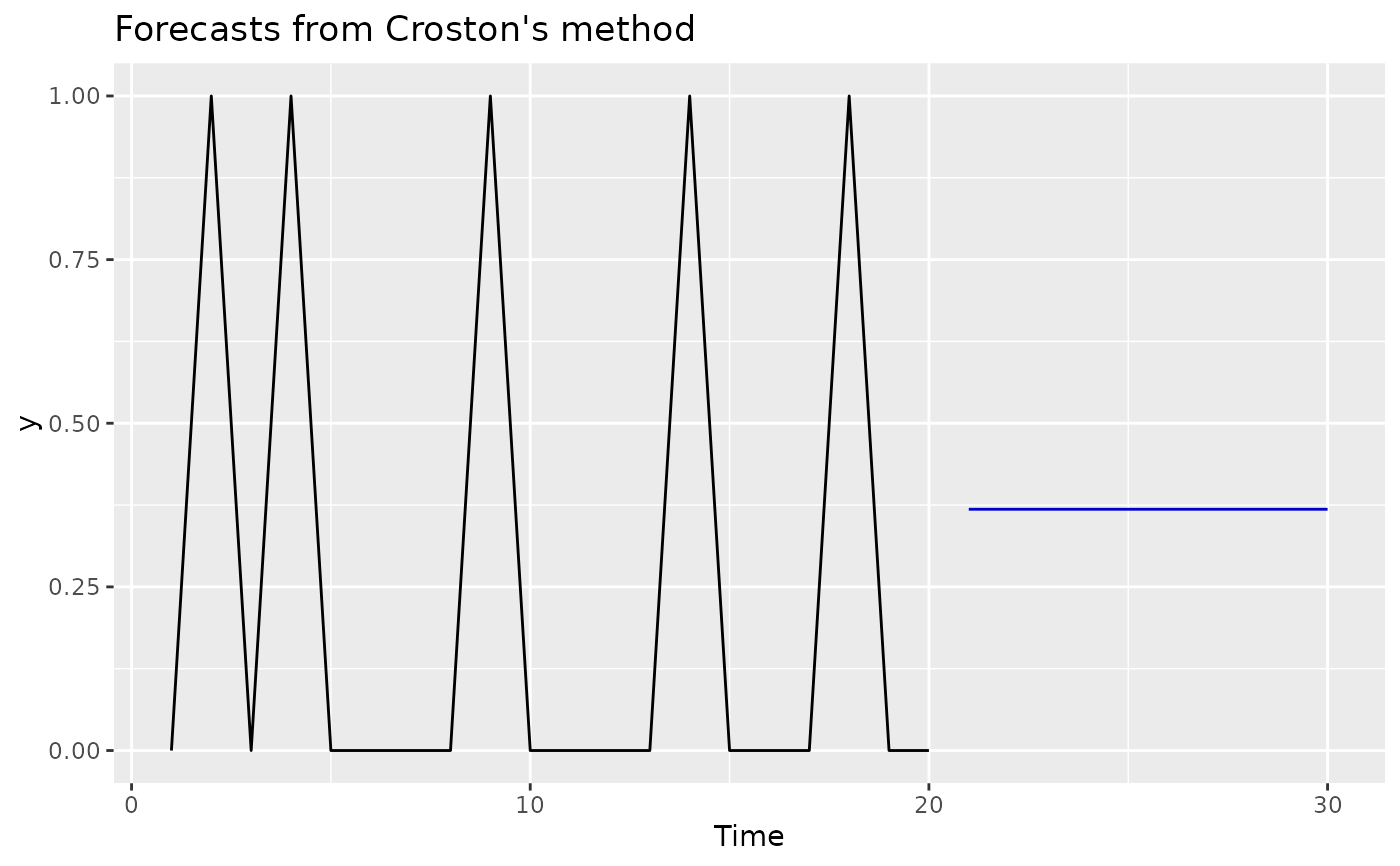

Forecasts for intermittent demand using Croston's method

Source:R/croston.R

forecast.croston_model.RdReturns forecasts and other information for Croston's forecasts applied to y.

Arguments

- object

An object of class

croston_modelas returned bycroston_model().- h

Number of periods for forecasting. Default value is twice the largest seasonal period (for seasonal data) or ten (for non-seasonal data).

- ...

Additional arguments affecting the forecasts produced. If

model = NULL,forecast.tspasses these toets()orstlf()depending on the frequency of the time series. Ifmodelis notNULL, the arguments are passed to the relevant modelling function.- y

a numeric vector or univariate time series of class

ts- alpha

Value of alpha. Default value is 0.1.

- type

Which variant of Croston's method to use. Defaults to

"croston"for Croston's method, but can also be set to"sba"for the Syntetos-Boylan approximation, and"sbj"for the Shale-Boylan-Johnston method.- x

Deprecated. Included for backwards compatibility.

Details

Based on Croston's (1972) method for intermittent demand forecasting, also

described in Shenstone and Hyndman (2005). Croston's method involves using

simple exponential smoothing (SES) on the non-zero elements of the time

series and a separate application of SES to the times between non-zero

elements of the time series. The smoothing parameters of the two

applications of SES are assumed to be equal and are denoted by alpha.

Note that prediction intervals are not computed as Croston's method has no underlying stochastic model.

forecast class

An object of class forecast is a list usually containing at least

the following elements:

- model

A list containing information about the fitted model

- method

The name of the forecasting method as a character string

- mean

Point forecasts as a time series

- lower

Lower limits for prediction intervals

- upper

Upper limits for prediction intervals

- level

The confidence values associated with the prediction intervals

- x

The original time series.

- residuals

Residuals from the fitted model. For models with additive errors, the residuals will be x minus the fitted values.

- fitted

Fitted values (one-step forecasts)

The function summary can be used to obtain and print a summary of the

results, while the functions plot and autoplot produce plots of the forecasts and

prediction intervals. The generic accessors functions fitted.values and residuals

extract various useful features from the underlying model.

References

Croston, J. (1972) "Forecasting and stock control for intermittent demands", Operational Research Quarterly, 23(3), 289-303.

Shale, E.A., Boylan, J.E., & Johnston, F.R. (2006). Forecasting for intermittent demand: the estimation of an unbiased average. Journal of the Operational Research Society, 57(5), 588-592.

Shenstone, L., and Hyndman, R.J. (2005) "Stochastic models underlying Croston's method for intermittent demand forecasting". Journal of Forecasting, 24, 389-402.

Syntetos A.A., Boylan J.E. (2001). On the bias of intermittent demand estimates. International Journal of Production Economics, 71, 457–466.